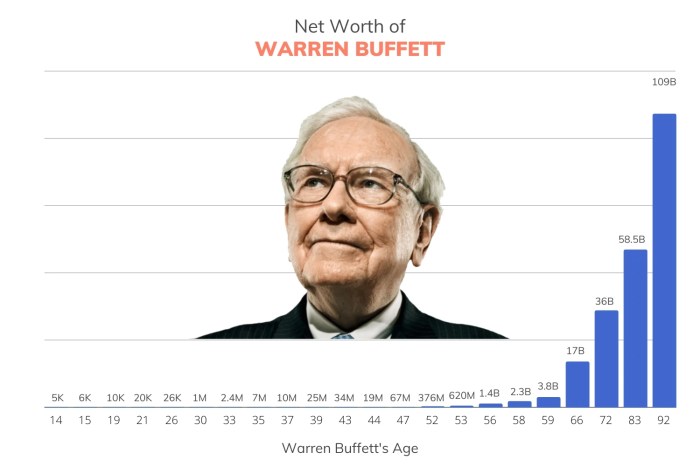

As Warren Buffett Net Worth 2020 Forbes takes center stage, this opening passage beckons readers into a world where fortunes are made and lost, where business magnates rise and fall, but one name stands tall – Warren Buffett. In this exclusive look, we delve into the mind of the Oracle of Omaha, uncovering the secrets behind his staggering net worth.

From stock market investing to high-stakes acquisitions, this is the inside story of how Warren Buffett became the wealthiest man alive.

Warren Buffett, the billionaire business magnate, has long been an enigma in the world of finance. His ability to consistently deliver market-beating returns and navigate the complexities of the global economy has solidified his position as a legend in the industry. But behind the persona of a shrewd businessman lies a complex individual with a vision for philanthropy that is changing the world.

Key Factors That Contribute to Warren Buffett’s Enormous Net Worth

Warren Buffett, one of the most successful investors in history, has a net worth that has consistently increased over the years, thanks to his exceptional business acumen, strategic investment approach, and leadership skills. At the forefront of his success is Berkshire Hathaway, a multinational conglomerate holding company with a diverse portfolio of businesses generating substantial returns.

Business Acumen: The Pillar of Warren Buffett’s Success

Warren Buffett’s uncanny ability to identify and invest in undervalued companies with strong potential has been a hallmark of his investment strategy. His keen eye for spotting market anomalies, combined with a deep understanding of finance and economics, allows him to pinpoint opportunities that others often overlook. For instance, his purchase of Coca-Cola in 1988, a bet on the company’s continued growth and popularity, reaped substantial rewards.

Similarly, his early investment in American Express, despite initial losses, eventually turned profitable due to the company’s diversified business and strong brand recognition.

- Value Investing: Buffett’s approach focuses on finding undervalued companies with a strong potential for growth.

- Economic Analysis: Buffett conducts thorough economic research to identify market inefficiencies and trends.

- Diversification: Berkshire Hathaway’s diverse portfolio, which includes insurance, retail, and manufacturing companies, contributes to significant returns.

Investment Strategy: The Secret to Warren Buffett’s Fortunes

Buffett’s investment strategy is centered around his philosophy of buying and holding onto high-quality, undervalued stocks. He avoids get-rich-quick schemes and speculative investments, focusing instead on the long-term potential of companies. For instance, his investment in See’s Candies in 1972, which he initially purchased at a price of $35 million, ultimately turned into a multibillion-dollar asset for Berkshire Hathaway.

Leadership Skills: A Key Driver of Berkshire Hathaway’s Success

Warren Buffett’s leadership has played a pivotal role in shaping Berkshire Hathaway’s success. His collaborative approach, willingness to take calculated risks, and emphasis on long-term growth have fostered a culture of innovation and accountability within the company. His ability to inspire top talent and attract visionary leaders has enabled Berkshire Hathaway to expand its operations and navigate complex business environments with ease.

The Impact of Berkshire Hathaway’s Business Portfolio

Berkshire Hathaway’s diverse business portfolio has been instrumental in contributing to Warren Buffett’s enormous net worth. The conglomerate’s investments in sectors such as insurance, retail, manufacturing, and energy have provided a stable foundation for growth and generated substantial returns. For instance, Berkshire Hathaway’s BNSF Railway, a $45 billion acquisition in 2010, has become a crown jewel of the company’s portfolio, accounting for significant revenues and profits.

“Price is what you pay, value is what you get.”

Warren Buffett

In conclusion, Warren Buffett’s success can be attributed to his exceptional business acumen, value-driven investment strategy, and leadership skills. His commitment to long-term growth and focus on identifying undervalued companies have allowed him to build an unparalleled net worth, solidifying his status as one of the greatest investors in history.

The Role of Berkshire Hathaway in Warren Buffett’s Net Worth in 2020

Berkshire Hathaway, Warren Buffett’s conglomerate, played a pivotal role in his net worth in 2020, contributing significantly to his net worth of over $100 billion. This behemoth of a company, founded in 1839, has transformed under Buffett’s leadership from a textile mill to a multinational conglomerate with interests in diverse sectors, including insurance, retail, and manufacturing.

The Diverse Business Portfolio of Berkshire Hathaway

Berkshire Hathaway’s investment portfolio is a key contributor to Warren Buffett’s net worth in

The conglomerate’s investments include a diverse range of businesses, such as:

- Insurance companies: Geico, General Re, and Berkshire Hathaway Reinsurance Group

- Retail: See’s Candies, Nebraska Furniture Mart, and Borsheims Fine Jewelry

- Manufacturing: Precision Castparts, Nebraska Machinery Company, and Marmon Group

- Energy: MidAmerican Energy, BHE Renewables, and Berkshire Hathaway Energy

- Technology: IBM, Apple, and Amazon

These businesses not only generate significant revenue but also provide a stable source of income, contributing to Warren Buffett’s net worth in 2020. The conglomerate’s diversified portfolio also reduces its dependence on any single industry, making it less vulnerable to market fluctuations.

Successful Acquisitions and Their Impact

Berkshire Hathaway has made numerous successful acquisitions over the years, which have significantly impacted Warren Buffett’s net worth in

2020. Some notable examples include

- Precision Castparts: Acquired in 2016 for $37.2 billion, adding a leading manufacturer of complex metal components for aerospace and industrial markets.

- IBM’s Credit Card Business: Acquired in 2017 for $900 million, providing Berkshire Hathaway with a significant presence in the credit card industry.

- Buffett’s $1 billion investment in BYD (Build Your Dreams) in 2008, turning $1 billion into $30 billion by 2010.

These acquisitions not only enhanced Berkshire Hathaway’s portfolio but also provided Warren Buffett with a significant boost to his net worth in 2020.

Leadership and Management

The leadership and management structure of Berkshire Hathaway also play a crucial role in Warren Buffett’s net worth in 2020. With a flat organizational structure, decision-making power rests with Buffett, allowing for swift and nimble decision-making. The conglomerate’s decentralized management style enables its business units to operate independently, fostering a culture of innovation and accountability.

, Warren buffett net worth 2020 forbes

, Warren buffett net worth 2020 forbes

Warren Buffett’s Net Worth and Succession Planning in 2020: Warren Buffett Net Worth 2020 Forbes

Warren Buffett’s unparalleled success in the business world is a testament to his meticulous approach to succession planning, which played a pivotal role in maintaining and increasing his net worth in 2020. As one of the most influential investors of our time, Buffett’s ability to identify and develop future leaders has been instrumental in preserving the integrity and continuity of his business empire.

The Importance of Succession Planning in Warren Buffett’s Net Worth

Succession planning is a vital component of any successful business leader’s strategy, and Warren Buffett is no exception. By identifying and developing key individuals to take over leadership roles, Buffett has ensured the continued growth and prosperity of Berkshire Hathaway, his flagship conglomerate. This approach has allowed him to focus on long-term investments and expand his business interests, secure in the knowledge that his legacy is in good hands.

- By developing a deep pipeline of future leaders, Buffett has been able to handpick the most capable individuals to take on key roles within Berkshire Hathaway.

- Successful succession planning enables the continuity of Buffett’s business legacy, allowing him to focus on high-level strategy and investment decisions.

- A well-planned succession strategy also provides a sense of stability and reassurance to investors, employees, and stakeholders, which can have a positive impact on a company’s overall performance.

The Role of the Berkshire Hathaway Board of Directors in Succession Planning

As the chairman of Berkshire Hathaway’s board of directors, Warren Buffett has cultivated a highly effective succession planning process, ensuring that future leaders are not only capable of taking over key roles but also share his values and commitment to the business’s long-term success. This board’s expertise and oversight have played a crucial role in shaping the company’s future and maintaining its position as a leader in various industries.

- The Berkshire Hathaway board of directors comprises highly experienced and respected individuals from various fields, providing guidance and expertise to Buffett and his team.

- The board’s involvement in succession planning helps to identify and develop potential future leaders, ensuring that Berkshire Hathaway remains a competitive force in the business world.

- Buffett’s partnership with the board enables him to tap into a diverse range of perspectives, ultimately leading to more informed and effective decision-making within the company.

Leadership Development and Succession Plans in Place for Warren Buffett’s Key Business Ventures

As Buffett continues to expand his business empire, he has implemented comprehensive leadership development programs and succession plans for his key ventures. By investing in the growth and education of future leaders, Buffett aims to maintain the long-term success of his businesses and ensure a smooth transition of leadership roles.

“The key is finding people who can do what you do, but better.”

- Berkshire Hathaway’s succession planning process involves identifying, developing, and evaluating potential future leaders for key roles within the company.

- Buffett and his team conduct thorough evaluations of prospective candidates, considering their leadership skills, industry knowledge, and cultural fit within the organization.

- The company’s comprehensive leadership development programs provide opportunities for growth, mentorship, and knowledge sharing, helping future leaders develop the skills and expertise required to lead Berkshire Hathaway’s businesses.

Comparing Succession Planning Approaches with Other Notable Business Leaders

While Warren Buffett’s succession planning approach has been widely admired and emulated, other notable business leaders have taken different approaches to ensure the continuity of their legacies. By examining these differing strategies, we can gain valuable insights into the most effective ways to maintain and grow a successful business.

| Leader | Succession Planning Approach |

|---|---|

| Bill Gates | Identifies and develops future leaders through the Bill & Melinda Gates Foundation and Microsoft’s succession planning processes. |

| Jeff Bezos | Employs a more decentralized approach, entrusting high-level decision-making to Amazon’s executive team and allowing for more autonomy in leadership development. |

Warren Buffett’s Net Worth and Leadership Philosophy in 2020

Warren Buffett, the Oracle of Omaha, is a legendary investor and businessman who has amassed an enormous net worth of over $90 billion in 2020. His remarkable success can be attributed to his unique leadership philosophy, which has been instrumental in driving the growth and prosperity of his business empire, Berkshire Hathaway. In this article, we will delve into the core principles of Buffett’s leadership philosophy and explore how they have contributed to his net worth in 2020.

Value Investing: A Key Tenet of Buffett’s Leadership Philosophy

Buffett’s leadership philosophy is built around the value investing approach, which involves identifying undervalued companies with strong fundamentals and potential for long-term growth. This approach requires a deep understanding of the company’s business, industry, and financials, as well as the ability to analyze and evaluate data to make informed investment decisions. Buffett’s success can be attributed to his ability to identify and capitalize on these undervalued opportunities, often purchasing companies at a significant discount to their intrinsic value.

Value investing is not just about finding cheap stocks; it’s about understanding the underlying business and its potential for growth.

The Importance of Long-Term Thinking

Buffett’s leadership philosophy is also characterized by a long-term focus, which has been instrumental in his success. He has consistently emphasized the importance of avoiding short-term market fluctuations and instead focusing on the long-term potential of his investments. This approach requires patience, discipline, and a deep understanding of the company’s business and finances. By taking a long-term view, Buffett has been able to ride out market downturns and capitalize on opportunities that others may have missed.

- Buffett’s long-term focus has allowed him to invest in companies that others have overlooked or written off.

- By taking a long-term view, Buffett has been able to avoid the emotional pitfalls of short-term market fluctuations.

- His focus on long-term growth has enabled him to build a diversified portfolio of high-quality companies that have delivered consistent returns over the years.

Effective Communication and Teamwork

Buffett’s leadership approach also emphasizes the importance of effective communication and teamwork. He has consistently highlighted the value of surrounding himself with talented and experienced professionals who share his vision and values. By creating a collaborative and inclusive work environment, Buffett has been able to build a strong team that is committed to achieving his goals. This has been instrumental in driving the success of Berkshire Hathaway and contributing to Buffett’s net worth in 2020.

Buffett’s emphasis on teamwork and collaboration has enabled him to build a strong and loyal team that is committed to achieving his vision.

Successful Leadership Decisions in 2020

In 2020, Buffett made several successful leadership decisions that contributed to his net worth. One notable example is his acquisition of Dominion Energy’s natural gas pipeline assets for $10 billion. This deal has been hailed as one of the most successful acquisitions in Berkshire Hathaway’s history, as it has helped the company to expand its presence in the energy sector and drive growth in its dividend payments.

Buffett’s acquisition of Dominion Energy’s natural gas pipeline assets demonstrates his ability to identify undervalued opportunities and capitalize on them.

Conclusion

In conclusion, Warren Buffett’s net worth in 2020 can be attributed to his unique leadership philosophy, which emphasizes value investing, long-term thinking, effective communication, and teamwork. His ability to identify undervalued opportunities, avoid short-term market fluctuations, and build a strong and loyal team has been instrumental in driving the success of Berkshire Hathaway. As we look to the future, it is clear that Buffett’s leadership philosophy will continue to be a key factor in his success and a inspiration to entrepreneurs and investors around the world.

Essential FAQs

What’s Warren Buffett’s investment approach?

Warren Buffett’s investment approach focuses on value investing, focusing on companies with strong fundamentals and a proven track record of profitability.

How does Berkshire Hathaway contribute to Warren Buffett’s net worth?

Berkshire Hathaway, the conglomerate led by Warren Buffett, is the primary driver of his net worth. The company’s diverse portfolio of businesses and investments generates substantial revenue and profits, which accumulate in Warren Buffett’s bank account.

What sets Warren Buffett apart from other billionaires?

Warren Buffett’s commitment to philanthropy, as demonstrated through the Buffett Pledge, where he has pledged to give away 99% of his fortune during his lifetime and beyond his death, sets him apart from other billionaires who prefer to keep their wealth for themselves.