Net worth of black family vs white family – Delving into the world of net worth, where numbers tell a story of stark contrasts between two distinct groups – black and white families in the United States. The narrative is complex, woven from the threads of history, policy, and systemic racism, with a subtle yet potent undertone of American culture. As we navigate this labyrinth, we find ourselves immersed in a world of statistics and anecdotes, where every number holds a secret and every voice echoes with a tale of triumph and struggle.

The numbers paint a picture of stark disparity: black families, on average, hold significantly less net worth than their white counterparts. But the story doesn’t end there. Behind these statistics lies a wealth of information, highlighting the deep-seated issues that have been shaping the course of American families for generations. Education, employment, housing, and financial markets all play a role in this complex dance, and it’s here that we see the intricate web of factors at play.

Exploring the disparities in median net worth between black and white families in the United States

The United States has long struggled with wealth inequalities, with African American families consistently facing significant disparities in median net worth compared to their white counterparts. This divide has its roots in centuries of systemic racism, from slavery to the present day, and has been exacerbated by policies and practices that have denied Black individuals access to education, housing, employment, and financial resources.

Historical Context of Wealth Inequality

The United States has historically been built on a foundation of inequality, with slavery, Jim Crow laws, and ongoing systemic racism shaping the economic experiences of Black Americans. Slavery, in particular, had a profound impact on the economic landscape of the country, denying Black people access to land, property, and financial resources. The legacy of slavery continues to affect the lives of Black Americans today, as they contend with the consequences of centuries-long disinvestment in their communities.

Average Income and Wealth Disparities

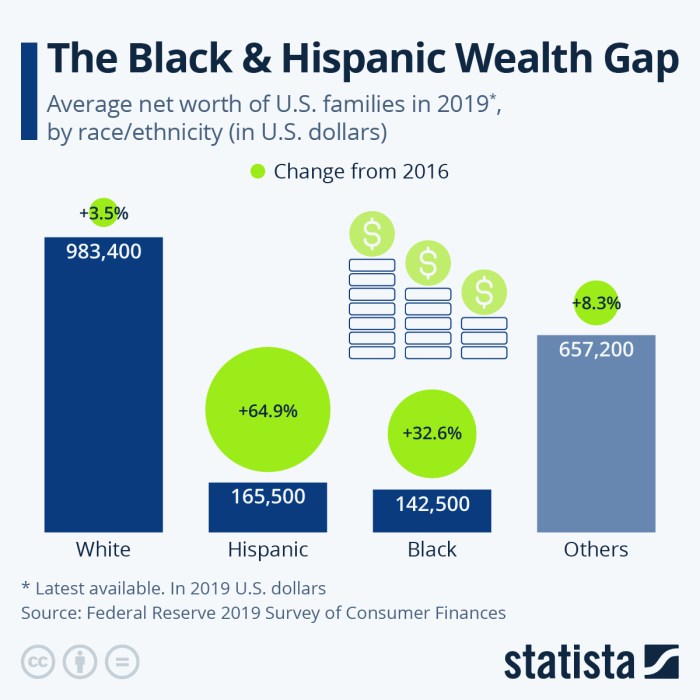

A breakdown of average income and wealth disparities between Black and white families reveals a stark picture of inequality. According to data from the Federal Reserve, in 2020, the median net worth for white families was $171,000, compared to just $17,600 for Black families. This disparity is even more pronounced when looking at different age groups. For example, in the 25-34 age range, white families had a median net worth of $91,400, compared to $10,700 for Black families.

This disparity is due in part to differences in income, education, and occupation, as well as unequal access to housing and financial markets.

The Role of Systemic Racism

Systemic racism has played a significant role in perpetuating these disparities, particularly in areas such as education, housing, employment, and financial markets. In education, for example, systemic racism has led to underfunding of schools in predominantly Black and Latino communities, resulting in limited access to quality education and resources. Similarly, in housing, discriminatory lending practices and zoning laws have denied Black families access to affordable housing and safe neighborhoods.

In employment, systemic racism has led to disparities in hiring, promotion, and pay, as well as barriers to entrepreneurship and business ownership. In financial markets, racism has led to unequal access to credit, loans, and other financial services, denying Black families the opportunity to build wealth and achieve financial stability.

Key Statistics and Data

Here are some key statistics and data that illustrate the disparities in median net worth between Black and white families:

- The median net worth for Black families in 2020 was $17,600, compared to $171,000 for white families. (Federal Reserve)

- In the 25-34 age range, the median net worth for white families was $91,400, compared to $10,700 for Black families. (Federal Reserve)

- The homeownership rate for Black families in 2020 was 42.7%, compared to 74.5% for white families. (American Community Survey)

- The median income for Black families in 2020 was $43,600, compared to $75,700 for white families. (American Community Survey)

Examples and Case Studies

The disparities in median net worth between Black and white families are not just statistics – they have real-life consequences for individuals and communities. For example, a study by the Brookings Institution found that, in the aftermath of the housing crisis, Black families lost an average of 63% of their wealth, compared to 46% for white families. This loss of wealth has had long-term consequences for Black families, making it even more difficult for them to achieve economic stability and security.

Road to Economic Justice

The disparities in median net worth between Black and white families are a stark reminder of the ongoing legacy of systemic racism in the United States. To address these disparities and achieve economic justice for Black families, policymakers and business leaders must take a comprehensive approach that addresses the root causes of inequality. This means increasing access to education, housing, employment, and financial resources, as well as dismantling systemic racism in all its forms.

By working together, we can create a more just and equitable economy that allows Black families to thrive and achieve their full potential.

Examining the impact of education and human capital on net worth differences between black and white families: Net Worth Of Black Family Vs White Family

The stark reality of financial disparities in the United States is a persistent issue, with black families often finding themselves struggling to make ends meet. A significant contributing factor to this disparity lies in the differences in education and human capital between black and white families.

Relationship between education levels and earning potential

Research has consistently shown that education levels have a direct correlation with earning potential. According to a study by the Economic Policy Institute, individuals with a bachelor’s degree can earn up to 50% more than those with a high school diploma. Conversely, a report by the Brookings Institution noted that in 2019, unemployment rates for high school dropout men aged 20-24 and 25-34 were significantly higher than those with at least a bachelor’s degree.

The data paints a clear picture: education can make all the difference in securing better-paying jobs and reducing unemployment rates.

Disparities in education access and quality

Unfortunately, the education system in the United States is not always equitable for black families. A study by the National Education Association found that schools in districts with predominantly black student populations receive significantly less funding than those in predominantly white districts. Additionally, research has shown that black students are often taught by less-qualified teachers, and have less access to advanced courses and educational resources.| School District Type | Average Per-Pupil Funding (2019) || — | — || Predominantly Black | $12,144 || Predominantly White | $17,555 |

Strategies for enhancing human capital, Net worth of black family vs white family

The good news is that there are steps black families can take to enhance their human capital and increase their earnings potential. One strategy is to prioritize education and seek out opportunities for further learning. This can include pursuing a higher degree, taking online courses, or attending professional development workshops. Furthermore, black families can focus on developing valuable skills, such as coding, data analysis, or marketing.

By investing in their education and skills, black families can increase their chances of securing better-paying jobs and achieving financial stability.

Empowering through education

Education is key to unlocking the potential of black families and bridging the financial divide. By recognizing the importance of equitable education and working towards creating a more inclusive education system, we can empower black families to achieve economic stability and build a brighter financial future.

Breaking the cycle

The cycle of financial instability can be broken, but it requires a concerted effort from policymakers, educators, and community leaders. By prioritizing education and providing black families with the resources they need to succeed, we can create a more level playing field and pave the way for a more equitable financial future.

Invest in education, invest in the future

The future of black families and the financial stability of our nation depend on our ability to close the education gap and empower black families with the knowledge and skills they need to succeed. By investing in education, we can break the cycle of financial insecurity and create a brighter, more prosperous future for generations to come.

Unpacking the relationship between homeownership and net worth among black and white families

Homeownership has long been touted as a key factor in building wealth, particularly in the United States, where owning a home can be a significant source of long-term financial security. However, despite its potential benefits, homeownership has not been a viable option for many black families, contributing to the persistent wealth gap between black and white households.For many black families, homeownership is still a distant dream, hindered by a range of structural barriers and policies that restrict access to affordable housing and mortgages.

These disparities are deeply ingrained in the nation’s history of racist housing policies, such as redlining and blockbusting, which have systematically excluded black communities from participating in the wealth-building benefits of homeownership.

Homeownership rates: A stark reminder of systemic disparities

According to data from the US Census Bureau, the homeownership rate for black families is significantly lower than that of white families. In 2020, the homeownership rate for black families was 41.6%, compared to 73.6% for white families. This stark contrast is not merely a reflection of individual choices, but rather a product of systemic inequalities that have been perpetuated over generations.

- The legacy of redlining, which denied black families access to mortgage financing and relegated them to living in poorly maintained, high-crime neighborhoods.

- The continued existence of discriminatory lending practices, which often result in black families being steered towards riskier, higher-interest mortgages.

- The lack of affordable housing options in many black communities, contributing to gentrification and displacement as white families and developers move in.

- The perpetuation of housing segregation, which limits black families’ access to wealth-building opportunities and reinforces existing wealth disparities.

The impact of gentrification and displacement

Gentrification, the process by which wealthier, white families move into historically black neighborhoods, has had devastating effects on black communities. As gentrification takes hold, the character of these neighborhoods is transformed, and black families are forced to move out, often at the behest of escalating rents and rising property values. This displacement not only erases the cultural heritage of black communities but also deprives them of the economic benefits that come with homeownership.

| Neighborhood | Homeownership Rate (2020) | Median Household Income (2020) |

|---|---|---|

| Shaw, Washington, D.C. | 44.6% | $83,435 |

| LeDroit Park, Washington, D.C. | 38.5% | $61,445 |

Gentrification is a powerful tool for erasing the very existence of black communities, and it is a threat to the future of homeownership for generations to come. As long as systemic barriers and discriminatory practices continue to exclude black families from accessing affordable housing and mortgage financing, the dream of homeownership will remain elusive for many black families.

“Wealth is not just a product of individual hard work and determination; it is also the result of systemic opportunities and advantages.” – Dr. Melvin L. Oliver, co-author of Black Wealth/White Wealth

FAQ Insights

Q: What are the primary factors contributing to the net worth disparity between black and white families?

A: Historically, systemic racism has played a significant role, affecting access to education, employment, housing, and financial markets. Additionally, policies such as redlining and discriminatory loan practices have further exacerbated the issue.

Q: How do intergenerational wealth transfer and inheritance impact net worth disparities?

A: Limited inheritance among black families has been a significant factor in perpetuating wealth gaps. Conversely, white families have historically enjoyed greater access to inheritances, reinforcing their net worth advantage.

Q: What role does education play in bridging the net worth gap?

A: Education is a key driver of earning potential and wealth accumulation. However, systemic barriers, such as funding disparities and unequal access to quality education, have hindered educational opportunities for black families.