Net worth ireland – As the Emerald Isle beckons expats and residents alike, navigating financial waters in Ireland can be a daunting task. Building a robust net worth in this land of lush landscapes and vibrant cities is no exception. Think of it as planting the seeds of financial stability, which will bloom into a bountiful harvest of prosperity and peace of mind.

But what exactly is net worth, and why is it a crucial aspect of personal finance in Ireland? Put simply, net worth is the difference between what you own (your assets) and what you owe (your liabilities). It’s a snapshot of your financial health, and maintaining a healthy net worth is essential for achieving long-term financial stability.

Net Worth in Ireland

Establishing a favorable net worth in Ireland is essential for expatriates and permanent residents, contributing significantly to their overall financial stability. As they navigate the complexities of personal finance, understanding the importance of a positive net worth is crucial. This concept serves as a vital metric, allowing individuals to gauge their financial health and make informed decisions about their financial futures.

Irish-Based Assets and Liabilities

Irish-based assets and liabilities can have a substantial impact on an individual’s net worth, and it’s essential to consider them. Here are some key examples:| Assets | Liabilities | Description || — | — | — || Residential Properties | Mortgages | Individuals may own residential properties in Ireland, while mortgages are loans secured against these properties. || Pension Funds | Pension Contributions | Pensions are retirement savings plans, while pension contributions refer to the amounts paid into these plans.

|| Savings Accounts | Credit Card Debts | Savings accounts and credit card debts are two common examples of Irish-based assets and liabilities. Savings accounts can hold accumulated funds, whereas credit card debts refer to outstanding balances on credit cards. || Investment Properties | Property Management Fees | Investment properties, such as rental properties, can be a valuable asset, while property management fees are expenses associated with maintaining these properties.

|

Financial Planning Strategies, Net worth ireland

To maintain a healthy net worth in Ireland, expatriates and permanent residents should implement various financial planning strategies. Developing a long-term strategy for accumulating wealth is essential for maintaining a positive net worth. Investing in assets such as stocks, bonds, and property can provide opportunities for growth and diversification.Regularly reviewing and updating one’s budget and financial plan is crucial for staying on track.Avoiding debt, particularly high-interest debt, is essential for maintaining a healthy financial situation.

Managing expenses and creating a sustainable budget can help individuals allocate resources efficiently and achieve their financial goals.

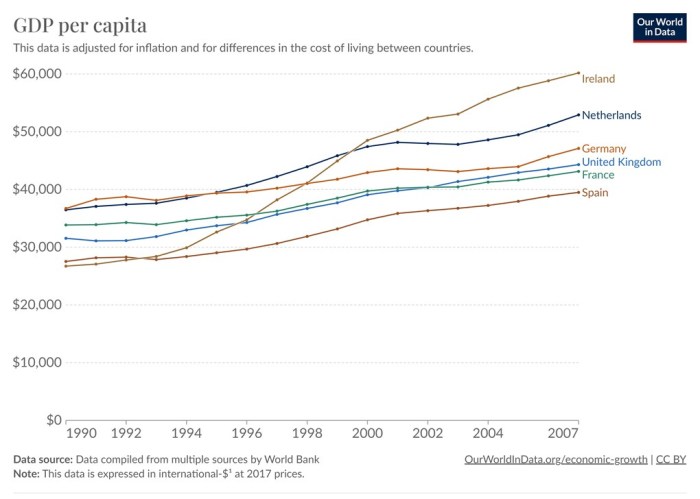

Net Worth in Ireland: A Comparison with Other European Countries

Ireland has a unique system for calculating net worth, which is influenced by its economic and tax policies. While there are similarities with other European countries, such as the UK, Germany, and France, there are also key differences in their systems.One key difference is the tax treatment of assets and liabilities. In Ireland, assets are generally taxed at a rate of 33%, while liabilities, such as mortgages and other debts, are subtracted from the total asset value before calculating net worth.

In the UK, the UK, on the other hand, the tax treatment of assets and liabilities is more complex, with different tax rates and reliefs applying to different types of assets.A similar system is found in Germany, where assets are also taxed, but the tax rate varies depending on the type of asset. In France, assets are also taxed, but the tax rate is lower than in Ireland, at 20%.

However, the French system has a higher tax threshold, so only assets above a certain value are subject to tax.Regulatory differences between Ireland and other European countries can have a significant impact on net worth. For example, Ireland’s system allows for a higher level of tax relief on mortgage interest, which can increase net worth. In the UK, the UK, this relief is not available, which can result in a lower net worth for individuals with significant mortgage debt.In Germany, the German tax authority has introduced new regulations to limit tax relief on mortgage interest, which has affected many homeowners and increased their net worth.

The French tax authority has also introduced changes to its tax system, which is affecting the tax treatment of assets and liabilities.Here are some key regulatory differences between Ireland and other European countries:

Regulatory Differences in Tax Treatment of Assets and Liabilities

Ireland, the UK, and other European countries have different regulatory frameworks for taxing assets and liabilities.

- Ireland’s system provides a higher level of tax relief on mortgage interest, which can increase net worth.

- In the UK, the UK, there is no tax relief on mortgage interest for individuals.

- In Germany, Germany’s tax authority has introduced regulations to limit tax relief on mortgage interest.

- In France, the tax rate on assets is lower than in Ireland, but the tax threshold is higher, resulting in less tax liability for some individuals.

These regulatory differences can have a significant impact on net worth and are worth considering when calculating net worth in Ireland compared to other European countries.

Tax relief on mortgage interest can increase net worth by reducing the amount of tax paid on interest income.

The tax treatment of assets and liabilities in Ireland and other European countries differs significantly, and regulatory changes can affect the net worth of individuals. Understanding these differences is essential for making informed decisions about assets and liabilities and minimizing tax liabilities. Ireland has a unique system for calculating net worth, influenced by its economic and tax policies. In order to increase net worth, it is vital to keep up with the tax treatment of assets and liabilities.

This knowledge will allow for the best outcomes when managing assets and liabilities.

Essential FAQs: Net Worth Ireland

Q: How often should I review my net worth in Ireland?

A: We recommend reviewing your net worth quarterly to track progress and make adjustments as needed.

Q: Can I use my Irish property as collateral for a loan?

A: Yes, but be cautious of mortgage rates and ensure you have a clear understanding of the terms and conditions.

Q: How do I choose between a pension plan and a 401(k) in Ireland?

A: Consider your financial goals, risk tolerance, and current employer contributions when making this decision.