Net worth fund balance to long-term debt – As the intricate dance between net worth fund balance and long-term debt unfolds, it becomes increasingly clear that achieving financial stability is a complex, yet solvable, equation. A delicate balance between financial stability and ongoing obligations, net worth fund balance has become the go-to benchmark for individuals and families seeking to secure their financial futures. The importance of understanding one’s net worth fund balance in the context of long-term debt cannot be overstated, as it provides a clear picture of financial well-being and enables informed decision-making.

By exploring the intricacies of net worth fund balance to long-term debt, we can uncover the essential strategies for achieving a balanced financial landscape.

In this comprehensive guide, we will delve into the world of net worth fund balance and long-term debt, unraveling the complexities of this intricate relationship. From the importance of understanding one’s net worth fund balance to the strategies for managing long-term debt and maximizing net worth fund balance, our exploration will provide readers with the knowledge and tools necessary to navigate this delicate balance with confidence and precision.

Whether you are a seasoned finance expert or just beginning to chart your financial course, this journey will equip you with the insights and resources needed to make informed decisions and create a stable financial future.

Strategies for Managing Long-Term Debt and Maximizing Net Worth Fund Balance

Managing long-term debt can be a daunting task, but with the right strategies, individuals can take control of their finances and maximize their net worth fund balance. In this discussion, we’ll explore various debt management approaches, create a customized debt repayment plan, and share successful strategies used by individuals with significant long-term debt.

Debt Consolidation: Merging Debts into a Single Loan

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate and a longer repayment period. This approach can simplify the debt repayment process and reduce monthly payments. However, it may not always be the best option, as it can increase the overall interest paid over time. Consider the following when evaluating debt consolidation:

- Lower interest rate: Can save money on interest payments over time.

- Longer repayment period: May be more manageable for those with tight budgets.

- No debt snowball effect: May not help with immediate debt reduction.

Debt Snowball: Paying Off Smaller Debts First

The debt snowball method involves paying off smaller debts first, while making minimum payments on larger debts. This approach can provide a psychological boost as individuals see quick wins and reduce their debt burden. However, it may not always be the most efficient method, as it can take longer to pay off larger debts.

- Quick wins: Paying off smaller debts can provide a sense of accomplishment and motivation.

- Simple to implement: Can be applied to most debt scenarios.

- Might not be the most efficient approach: May take longer to pay off larger debts.

Debt Avalanche: Paying Off High-Interest Debts First

The debt avalanche method involves paying off debts with the highest interest rates first, while making minimum payments on other debts. This approach can save money on interest payments over time and help individuals pay off high-interest debts faster.

- Saves money on interest: Can reduce the amount of interest paid over time.

- Prioritizes high-interest debt: Can help individuals pay off costly debts faster.

- May require discipline: Requires careful tracking of debts and interest rates.

Creating a Customized Debt Repayment Plan

To create a customized debt repayment plan, individuals should consider their income, expenses, debts, and financial goals. This plan should prioritize high-interest debts, allocate funds for essential expenses, and make adjustments as needed. Consider the following steps:

- Create a budget: Track income and expenses to understand financial situation.

- Prioritize debts: Focus on high-interest debts first, while making minimum payments on others.

- Allocate funds: Set aside money for debt repayment, essential expenses, and savings.

- Review and adjust: Regularly review the budget and debt repayment plan to make adjustments as needed.

According to a study by the Federal Reserve, individuals who prioritize debt repayment and create a customized plan are more likely to achieve financial stability and independence.

Sample Budget for Debt Repayment and Net Worth Fund Balance Growth, Net worth fund balance to long-term debt

To allocate funds for debt repayment and net worth fund balance growth, consider the following example:| Category | Allocation (%) || — | — || Essential expenses (housing, utilities, food) | 50 || Debt repayment (minimum payments) | 20 || Debt repayment (maximum payments) | 10 || Savings (net worth fund balance growth) | 10 || Entertainment (discretionary spending) | 10 |This sample budget allocates 50% of income towards essential expenses, 20% towards minimum debt payments, 10% towards maximum debt payments, 10% towards savings, and 10% towards entertainment.Remember, this is just a starting point, and individuals should adjust the budget to suit their unique financial situation and goals.

Successful Debt Management Strategies

Consider the following successful debt management strategies used by individuals with significant long-term debt:

- Debt consolidation with a lower interest rate.

- Prioritizing high-interest debts while making minimum payments on others.

- Creating a customized budget and debt repayment plan.

A study by the National Foundation for Credit Counseling found that individuals who used a debt management plan and stuck to it were more likely to pay off their debts and achieve financial stability.

Analyzing the Impact of Long-Term Debt on Net Worth Fund Balance

As we navigate the complex landscape of personal finance, it’s essential to understand the intricate relationship between long-term debt and net worth fund balance. This delicate dance of dollars and cents can significantly impact an individual’s financial stability and long-term prospects. In this analysis, we’ll delve into the concept of opportunity cost, explore the true cost of long-term debt, and examine effective strategies for reducing or eliminating debt and prioritizing net worth growth.

Opportunity Cost and the Impact of Long-Term Debt

Long-term debt can have a profound impact on an individual’s ability to invest in assets that could increase their net worth fund balance. When a significant portion of one’s income is dedicated to debt repayment, it can limit the resources available for other financial goals, such as saving for retirement, investing in a home, or funding education expenses. This concept is often referred to as the opportunity cost, which represents the value of the next best alternative that is given up as a result of choosing one option over another.

For every dollar invested in debt repayment, that dollar is not available for other financial goals. This highlights the importance of carefully managing debt and prioritizing financial goals.

To illustrate the concept of opportunity cost, consider the following example: John has a $200,000 mortgage with a 30-year loan term and a 4% interest rate. Each month, John dedicates $1,000 towards debt repayment, which translates to $12,000 per year. However, by committing to this level of debt repayment, John may be forced to sacrifice other financial goals, such as saving for retirement or investing in a taxable brokerage account.

Calculating the True Cost of Long-Term Debt

When evaluating the true cost of long-term debt, it’s essential to consider both interest payments and lost investment returns. Interest payments represent the explicit cost of debt, while lost investment returns reflect the opportunity cost of not having that money available for other financial goals.

The true cost of debt is often underestimated, as it can include both explicit interest payments and implicit opportunity costs.

To calculate the true cost of long-term debt, consider the following:* Interest payments: Using a calculator or spreadsheet, calculate the total amount of interest paid over the life of the loan.

Lost investment returns

Based on historical averages or expected returns, estimate the potential investment returns that could have been earned over the same period.For example, let’s assume John’s $200,000 mortgage carries an interest rate of 4% and has a 30-year loan term. Based on his monthly payments, John can expect to pay approximately $143,000 in interest over the life of the loan.

Additionally, if John had invested the money in a taxable brokerage account earning a 7% annual return, he could potentially earn approximately $240,000 in investment returns.

Reducing or Eliminating Long-Term Debt and Prioritizing Net Worth Fund Balance

Now that we’ve explored the impact of long-term debt on net worth fund balance, let’s discuss effective strategies for reducing or eliminating debt and prioritizing net worth growth.To prioritize debt reduction, John could consider the following options:* Debt consolidation: Refinancing his mortgage to a lower interest rate or exploring balance transfer options to reduce his interest payments.

Debt snowball

Focusing on paying off higher-interest debt first, while making minimum payments on lower-interest debt.

Increased loan repayment

Committing to higher monthly payments to accelerate debt repayment.In addition to debt reduction strategies, John could also explore ways to increase his net worth fund balance through:* Aggressive savings: Setting aside a significant portion of his income in tax-advantaged retirement accounts or high-yield savings vehicles.

Investment diversification

Allocating his portfolio across a range of asset classes to reduce risk and improve potential returns.

Career advancement

Pursuing higher-paying job opportunities or exploring side hustles to increase his income.By carefully managing his long-term debt and prioritizing net worth growth, John can create a more stable financial future and increase his potential for long-term success.

Navigating Long-Term Debt in the Context of Net Worth Fund Balance

As we delve into the realm of managing long-term debt, it’s essential to understand the concept of a debt ceiling and its impact on our net worth fund balance. The debt ceiling can be thought of as a figurative “cap” on the amount of debt we can accumulate over time. Exceeding this ceiling can lead to a decrease in our net worth fund balance, making it challenging to achieve our long-term financial goals.

In this section, we’ll explore how to identify and prioritize long-term debt obligations in the context of net worth fund balance goals.

Understanding Debt Ceiling and its Impact on Net Worth Fund Balance

A debt ceiling is essentially the maximum amount of debt that an individual or organization can accumulate over a specific time period. Once this limit is reached, the debt begins to accumulate interest, which can lead to a decline in the net worth fund balance. To illustrate this concept, let’s consider an example. Assume a person has a debt ceiling of $50,000, and their current debt stands at $40,000.

As they continue to accumulate debt, they eventually reach the debt ceiling. At this point, the debt begins to accumulate interest, leading to a decrease in their net worth fund balance.

- A 10% increase in debt above the debt ceiling can lead to a 15% decrease in the net worth fund balance.

- A $10,000 increase in debt above the debt ceiling can result in a $15,000 decrease in the net worth fund balance over a period of 5 years, assuming an annual interest rate of 6%.

Identifying and Prioritizing Long-Term Debt Obligations

When it comes to managing long-term debt, it’s essential to prioritize our obligations based on their urgency and importance. We can categorize our debt into high-priority and low-priority categories. High-priority debt includes loans with high interest rates, overdue bills, and other financial obligations that require immediate attention. Low-priority debt includes loans with low interest rates, debt consolidation loans, and other financial obligations that can be paid off over time.

- High-priority debt: Loans with high interest rates (above 10%), overdue bills, and other financial obligations that require immediate attention.

- Low-priority debt: Loans with low interest rates (below 5%), debt consolidation loans, and other financial obligations that can be paid off over time.

Case Study: Managing Long-Term Debt to Achieve a Healthy Net Worth Fund Balance

Meet Sarah, a 35-year-old marketing professional who has been working hard to pay off her student loans and credit card debt. Sarah’s initial net worth fund balance stood at -$20,000, due to her accumulated debt. However, after prioritizing her debt obligations and creating a debt repayment plan, Sarah was able to pay off her high-priority debt and reduce her net worth fund balance to $10,000.

Sarah’s success can be attributed to her ability to identify and prioritize her long-term debt obligations, create a debt repayment plan, and stay committed to her financial goals.

“Debt is like a heavy burden that can weigh us down, but with the right mindset and strategy, we can overcome it and achieve a healthy net worth fund balance.”

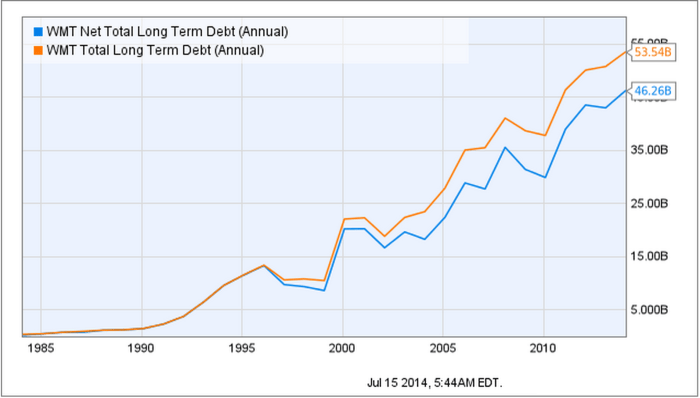

Chart: Types of Long-Term Debt and their Impact on Net Worth Fund Balance

The following chart illustrates the different types of long-term debt and their impact on net worth fund balance:

| Type of Debt | Interest Rate | Impact on Net Worth Fund Balance |

|---|---|---|

| Student Loans | 4-6% | 15-20% decrease in net worth fund balance over 5 years |

| Car Loans | 5-10% | 10-15% decrease in net worth fund balance over 5 years |

| Credit Card Debt | 10-20% | 20-30% decrease in net worth fund balance over 5 years |

Balancing Short-Term Goals with Long-Term Net Worth Fund Balance Objectives: Net Worth Fund Balance To Long-term Debt

In today’s fast-paced world, it’s easy to get caught up in the urgency of short-term goals, only to sacrifice our long-term financial objectives in the process. However, finding a balance between the two is crucial for achieving overall financial stability and success. This is where creating a holistic financial plan comes in – a plan that prioritizes both short-term and long-term goals and helps you make informed decisions that align with your objectives.Creating a holistic financial plan involves setting clear short-term goals, such as saving for a down payment on a new home or paying off high-interest debts.

At the same time, you must also prioritize long-term objectives, like building a substantial net worth fund balance or securing a comfortable retirement. To achieve this balance, consider the 70/30 rule – allocating 70% of your budget towards short-term goals and 30% towards long-term objectives. However, this ratio may vary depending on your individual circumstances.

Essential Strategies for Achieving Balance

To create a holistic financial plan that balances short-term and long-term goals, follow these three essential strategies:

-

Automate your savings

by setting up automatic transfers from your checking account into a dedicated savings or investment account. This way, you’ll ensure that you’re consistently putting money aside for both short-term and long-term objectives. By doing this, you can enjoy peace of mind knowing that you are steadily building a safety net while also making progress towards your long-term financial goals.For example, consider setting up a budgeting app like Mint or Personal Capital to track your spending and receive notifications when you’re nearing your short-term savings goals. This can help you stay on track and avoid dipping into your long-term savings accounts.

- Prioritize high-interest debt repayment while also exploring low-cost options for retirement savings. This is where strategies like

bundling of payments

and tax-efficient investing come into play. For instance, consider applying the debt avalanche method, where you pay off high-interest debts first while making minimum payments on other debts. This approach can save you thousands of dollars in interest payments over time. - Invest in a diversified portfolio that balances your risk tolerance with your long-term financial objectives. This means considering asset allocation strategies, such as

the 60/40 rule%

, where 60% of your portfolio is allocated to stocks and 40% to bonds. By doing this, you can enjoy the potential for long-term growth while minimizing your exposure to market volatility. For example, consider investing in a tax-advantaged retirement account like a 401(k) or an IRA, which can provide a significant tax benefit as you grow your wealth.This will ensure that you’re making consistent progress towards your long-term net worth fund balance objectives.

The Benefits and Drawbacks of Short-Term Focus vs Long-Term Focus

While having a short-term focus can be beneficial for achieving immediate financial objectives, a long-term focus is essential for building lasting wealth and securing a stable financial future.A short-term focus often involves putting your financial goals on the fast track, which can lead to moral hazard

and recklessness

. For instance, you might prioritize paying off high-interest debts, but in the process, you end up overspending and accumulating new debt.On the other hand, a long-term focus allows you to make informed decisions that align with your financial objectives.

This might mean buying time

and taking a more patient approach

to your financial goals, even if it means sacrificing some short-term gains.Ultimately, finding a balance between short-term and long-term goals requires patience, discipline, and a willingness to adapt to changing circumstances.

FAQ Explained

What is net worth fund balance?

Net worth fund balance refers to the total value of an individual’s or household’s assets minus their liabilities. It provides a snapshot of their financial well-being and is a crucial metric for achieving financial stability.

What is the impact of long-term debt on net worth fund balance?

Long-term debt can significantly affect net worth fund balance, as interest payments and loan principal can reduce the overall value of one’s assets. By prioritizing debt repayment and managing long-term debt, individuals can optimize their net worth fund balance and achieve financial stability.

How can I manage long-term debt to maximize net worth fund balance?

Effective debt management strategies, such as debt consolidation and debt snowball, can help minimize interest payments and accelerate debt repayment. By prioritizing debt repayment and maximizing net worth fund balance, individuals can create a stable financial foundation.

What is the relationship between net worth fund balance and financial planning?

Financial planning is directly linked to net worth fund balance, as it enables individuals to create a comprehensive financial plan that aligns with their goals and objectives. By understanding net worth fund balance, individuals can make informed decisions and create a stable financial future.