How to calculate net worth for fafsa – As the financial landscape of higher education unfolds with the ever-changing dynamics of funding and eligibility, the importance of calculating net worth for FAFSA applications cannot be overstated. Like a masterful puzzle solver, accurately piecing together one’s financial picture can be the difference between securing that dream college spot or being left in the dust. From the intricate dance of assets and liabilities to the often-overlooked realm of non-reportable transactions, every calculation counts.

It’s time to take the mystery out of net worth and make it a straightforward, empowering tool for students and families.

Calculating net worth for the Free Application for Federal Student Aid (FAFSA) is a vital step in determining financial aid eligibility, and it’s crucial to understand the process to avoid common pitfalls and errors. With so much on the line, taking the time to learn how to calculate net worth accurately will pay off in the long run.

Calculating Net Worth for FAFSA Application: Why it Matters

Calculating net worth is a crucial step in the FAFSA (Free Application for Federal Student Aid) application process. It not only helps students and families determine their eligibility for financial aid but also provides an accurate picture of their financial situation. The net worth calculation is used to assess the family’s ability to pay for college expenses and is a key factor in determining the Expected Family Contribution (EFC).Calculating net worth requires families to disclose their assets, liabilities, and other financial information on the FAFSA.

This information is used to determine the EFC, which is then used by colleges and universities to determine the student’s financial aid eligibility.

Consequences of Incorrect Net Worth Reporting

Incorrect or incomplete net worth reporting can have serious consequences on a student’s financial aid eligibility. If a family underreports their net worth or fails to disclose certain assets, they may be subject to a loss of financial aid eligibility. Conversely, if a family overreports their net worth, they may be expected to contribute more to the student’s education expenses.

Accurate Net Worth Calculation: The Key to Maximizing Financial Aid

Accurate net worth calculation can make a significant difference in a student’s financial aid eligibility. For example, in 2020, a student with a family net worth of $100,000 may receive $10,000 more in financial aid if their parents correctly disclose their assets and liabilities. This additional funding can make a substantial difference in a student’s ability to afford college expenses.The consequences of incorrect net worth reporting can also be severe.

According to the US Department of Education, students who fail to disclose certain assets, such as retirement accounts or real estate investments, may be subject to a loss of up to 25% of their financial aid eligibility.

Examples of Net Worth Calculation in Action

A family with a net worth of $500,000 may be expected to contribute $10,000 more to their child’s education expenses if they fail to disclose their vacation home. Conversely, a family with a net worth of $200,000 may receive $5,000 more in financial aid if they accurately disclose their assets and liabilities.

| Families with $500,000 Net Worth | Families with $200,000 Net Worth |

|---|---|

| Expected Contribution: $10,000 more | Expected Aid: $5,000 more |

In conclusion, accurate net worth calculation is crucial for FAFSA application. Families must ensure they correctly disclose their assets, liabilities, and other financial information to maximize their financial aid eligibility and avoid potential losses.

Gathering Essential Documents and Information for Net Worth Calculation

To calculate your net worth for the FAFSA application, you’ll need to gather a variety of documents and information. This process can be time-consuming, but it’s essential to ensure accuracy and compliance with FAFSA guidelines.For a smooth and stress-free process, make sure to gather the following essential documents and information:

Tax Returns

Tax returns are a crucial part of the net worth calculation process. You’ll need to provide your previous year’s tax returns, including any supporting documentation such as W-2s and 1099s. This information helps determine your income, deductions, and credits, which are used to calculate your net worth.

- Previous year’s tax returns (including W-2s and 1099s)

- Taxpayer Identification Number (TIN) or Social Security Number (SSN)

- Federal tax returns from prior years, if required

Bank Statements

Bank statements provide a snapshot of your financial activity, including deposits, withdrawals, and balances. To ensure accuracy, use bank statements that reflect your financial situation at the time of the application.

- Copies of bank statements for checking and savings accounts

- Copies of bank statements for investments, such as stocks and bonds

- Copies of bank statements for retirement accounts, such as 401(k) or IRA

Asset Valuations

Asset valuations help determine the current value of your assets, such as real estate, cars, and other valuable items. You’ll need to provide documentation that supports the value of your assets, such as appraisal reports or market value estimates.

- Appraisal reports for real estate properties

- Market value estimates for vehicles, artwork, or other valuable items

- Copies of property deeds or titles

Verification and Documentation

To ensure accuracy and compliance with FAFSA guidelines, it’s essential to verify and document the required information. You can obtain this information from various sources, including your bank, financial advisor, or tax preparer.

Copies of verification letters or documentation from your bank, financial advisor, or tax preparer can help support the accuracy of your application. Be sure to keep these records in a safe and easily accessible location, as they may be requested during a potential audit.

According to the FAFSA website, students and parents are required to sign and submit the FAFSA application, including verifying the accuracy of the information provided. It’s essential to read and understand the instructions carefully to avoid errors or delays in processing.

Importance of Keeping Accurate Records

Keeping accurate records and documentation is crucial for potential future audits. Your records, including income statements, bank statements, and asset valuations, provide proof of your financial situation at the time of the application.

Audit officials will verify the information provided on your FAFSA application, so it’s essential to maintain accurate and complete records. This can help avoid errors, inconsistencies, or potential fines or penalties.

Calculating Net Worth

Net worth is a key determinant in the Financial Aid for Students and Families (FAFSA) application process, as it helps assess a family’s ability to contribute financially to a student’s education. The process of calculating net worth involves evaluating a family’s assets, liabilities, and financial interests to arrive at a net worth figure.To calculate net worth, families must consider both the assets and liabilities that impact their financial situation.

Here’s a step-by-step guide to calculating net worth:Net Worth = Total Assets – Total LiabilitiesNet Worth = (Assets – Liabilities) + Financial Interests

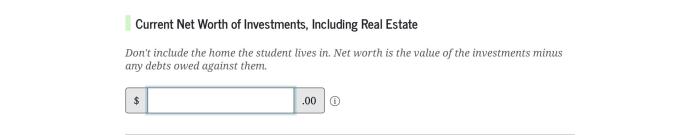

Assets, Liabilities, and Financial Interests, How to calculate net worth for fafsa

A detailed table will help illustrate the calculation of net worth. The following table includes columns for assets, liabilities, and financial interests, as well as additional columns to account for complex financial situations.| Assets | Cash Value | Ownership Status | Appreciation | Tax Implications || — | — | — | — | — || Real Estate | $200,000 | Jointly owned | Yes | Deferment until sale || Vehicles | $30,000 | Owned outright | No | Depreciation || Liabilities | Type | Balance | Interest Rate | Payment History || — | — | — | — | — || Loans | Federal student loan | $10,000 | 4.5% | On time || Credit Cards | Personal credit card | $2,000 | 18% | Missed payments || Mortgages | Home mortgage | $150,000 | 3.5% | Current || Financial Interests | Type | Value | Ownership Status | Annual Income || — | — | — | — | — || Investments | Stocks | $50,000 | Jointly owned | $3,000 || Bonds | Government bond | $10,000 | Solely owned | $500 |

Categorizing and Calculating the Value of Assets

Families must categorize and calculate the value of different types of assets, including real estate, vehicles, and investments.

Real estate

Calculate the current market value of the property, minus any outstanding mortgages or loans.

Vehicles

Evaluate the current market value of the vehicle, considering its make, model, year, and condition.

Investments

Evaluate the current value of investments, including stocks, bonds, and other securities.Net worth calculation for the example above:Total Assets: $200,000 (real estate) + $30,000 (vehicles) + $50,000 (investments) + $10,000 (bonds) = $290,000Total Liabilities: $10,000 (loans) + $2,000 (credit cards) + $150,000 (mortgages) = $162,000Financial Interests: $3,000 (annual income from investments) + $500 (annual income from bonds) = $3,500Net Worth = Total Assets – Total Liabilities + Financial InterestsNet Worth = $290,000 – $162,000 + $3,500Net Worth = $131,500

Accounting for Liabilities and Financial Interests

Families must account for liabilities and financial interests, including outstanding debts, loans, and credit card balances.

Outstanding debts

Calculate the current balance of outstanding debts, including credit cards, mortgages, and loans.

Financial interests

Evaluate the current value of financial interests, including investments, bonds, and other securities.Families with complex financial situations, such as joint ownership or shared debts, must consider the ownership status and tax implications when calculating net worth.

Common Challenges and Errors in Net Worth Calculation for FAFSA Application: How To Calculate Net Worth For Fafsa

Calculating your net worth for the FAFSA application can be a daunting task, but it’s crucial to get it right to ensure you receive accurate financial aid awards. Many students and families struggle with common challenges and errors that can impact their eligibility and financial aid packages. In this section, we’ll explore common pitfalls and strategies for overcoming them, helping you navigate the complexities of net worth calculation.

Incorrect Asset Valuation

One of the most significant challenges in calculating net worth is valuing assets accurately. This includes real estate, retirement accounts, and investments. Incorrect valuations can lead to significant variations in net worth calculations, resulting in incorrect financial aid awards. To avoid this pitfall, it’s essential to understand how to value assets correctly. Consider the following:

- A home owned by you, your spouse, or your dependent, will be considered an asset. However, the family’s primary residence is exempt, meaning no value is assigned to it.

- Retirement accounts, such as 401(k), IRA, and pension plans, are considered assets and will be included in the calculation.

- Investments, such as stocks, bonds, and mutual funds, are also considered assets and will be included in the calculation.

To accurately value your assets, consider using online resources, such as the Federal Reserve’s website, which provides estimates for various asset values. Additionally, consult with financial aid advisors or use online calculators to ensure accurate valuations.

Incomplete Documentation

Gathering the necessary documents to support your net worth calculation is crucial. Incomplete documentation can lead to errors and omissions, resulting in incorrect financial aid awards. Ensure you have the following documents:

- A detailed list of all assets, including bank statements, brokerage account statements, and retirement account statements.

- A list of debts, including credit card debt, student loans, and personal loans.

- A detailed list of expenses, including rent, utilities, and other monthly expenses.

To overcome incomplete documentation, consider the following strategies:

- Keep accurate and up-to-date records of your financial assets and liabilities.

- Consult with financial aid advisors or use online resources to help guide you through the documentation process.

- Use online templates or spreadsheets to track your expenses and assets.

Failure to Account for Certain Financial Interests

Failing to account for certain financial interests can result in incorrect net worth calculations. This includes:

- Business interests, such as a family-owned business or self-employment income.

- Stock options, warrants, or equity in a business.

- Non-cash assets, such as real estate, art, or collectibles.

To avoid this pitfall, consider the following:

- Consult with financial aid advisors or tax professionals to ensure you’re accounting for all financial interests.

- Use online resources or calculators to accurately value complex assets.

- Keep accurate and up-to-date records of your financial interests.

Examples of Incorrect Net Worth Calculation

Incorrect net worth calculations can have significant consequences on FAFSA eligibility and financial aid awards. Consider the following example:

For example, if a family incorrectly values their primary residence, resulting in a higher net worth calculation, they may be ineligible for certain types of financial aid.

In this scenario, the family may be incorrectly assessed as having a higher income or assets, resulting in reduced or eliminated financial aid eligibility.By understanding common challenges and errors in net worth calculation, you can avoid these pitfalls and ensure accurate financial aid awards. Remember to keep accurate records, consult with financial aid advisors, and use online resources to help guide you through the process.

User Queries

Can I ignore non-reportable transactions when calculating my net worth for FAFSA?

No, non-reportable transactions such as gifts and inheritances must be excluded from your net worth calculation for FAFSA purposes.

What happens if I make an error in my net worth calculation?

Mistakes in net worth calculations can lead to incorrect financial aid awards or even trigger audits or re-evaluations. It’s essential to double-check your calculations and consult with financial aid advisors if needed.

Do I need to disclose every single financial transaction when calculating my net worth?

No, FAFSA does not require disclosure of every single financial transaction. However, you should only exclude reportable transactions that are not required to be reported.

How often should I review and update my financial records for FAFSA purposes?

Avoid the stress of last-minute scrambles and review your financial records regularly to ensure accuracy, especially before applying for FAFSA.