Apple. net worth – As Apple’s net worth takes center stage, it’s time to shine a light on the tech giant’s remarkable journey from humble beginnings to becoming one of the world’s most valuable companies. With a history spanning over 40 years, Apple has transformed the way we live, work, and play.

From the first Macintosh computer to the sleek, user-friendly iPhones of today, Apple’s products have consistently pushed the boundaries of innovation and design. But what lies behind Apple’s incredible success? How has the company managed to grow its net worth to unparalleled heights while maintaining its loyal customer base? In this article, we’ll delve into the fascinating world of Apple’s net worth, exploring the company’s evolution, financial strategies, and key performance indicators that drive its growth.

The Role of Design in Apple’s Net Worth

Apple’s commitment to design has been a key driver in its unprecedented success and staggering net worth. The company’s relentless pursuit of creating products with sleek, user-friendly interfaces and minimalist aesthetics has not only wowed consumers, but also influenced the tech industry as a whole. By focusing on design, Apple has been able to differentiate its products from those of competitors and foster a loyal customer base.Design has played a pivotal role in shaping Apple’s products, from the iconic Macintosh computer to the widely popular iPhone.

The company’s design-driven approach has resulted in a seamless user experience, making complex technologies accessible to a broad audience. This focus on user experience has, in turn, created a loyal following, with customers willing to pay a premium for Apple’s products.

Sleek and User-Friendly Interfaces

One of the most notable aspects of Apple’s design philosophy is its emphasis on creating products with intuitive interfaces. The iPhone’s multi-touch screen technology, for instance, revolutionized the way people interacted with their smartphones. Apple’s use of simple, gestures-based interfaces has made complex features easily accessible, making it a breeze for users to navigate their devices. This streamlined experience has not only won over customers but also inspired competitors to adopt similar design approaches.

- The iPhone’s multi-touch screen technology has enabled users to access a wide range of features with ease, from checking emails to browsing the web.

- The iPad’s large touchscreen display has made it an ideal device for reading, browsing, and gaming, cementing its position as a staple in the tech industry.

- Apple’s MacBooks have been praised for their sleek and portable designs, making them a favorite among professionals and students alike.

The impact of Apple’s design-driven approach can be seen not only in its products but also in the broader tech industry. Competitors like Samsung and Google have been forced to revisit their design strategies, incorporating elements of Apple’s minimalist aesthetic into their own products. This has, in turn, raised the bar for the entire industry, driving innovation and pushing the boundaries of what is possible in technology.

Differentiation and Loyalty

Apple’s focus on design has helped differentiate its products from those of competitors, creating a loyal customer base that is willing to pay a premium for its products. This loyalty is rooted in the seamless user experience that Apple’s design philosophy provides. By making complex technologies accessible, Apple has created a sense of security and trust among its customers, who feel at ease using its products.This sense of loyalty is evident in the way Apple’s customers evangelize the brand, enthusiastically recommending its products to friends and family.

Apple’s products have become status symbols, with some consumers willing to wait in line for hours to get their hands on the latest iPhone or Mac. This level of loyalty is a testament to the power of design in shaping consumer behavior and driving business success.

Influence on the Tech Industry

Apple’s design-driven approach has had a profound impact on the tech industry, influencing not only competitors but also startups and innovators. The company’s focus on user experience has created a new paradigm for product development, putting the user at the forefront of the design process.

Design as a Driver of Innovation

By putting design at the forefront of its product development process, Apple has created a culture of innovation that inspires new ideas and pushes the boundaries of what is possible in technology. This focus on design has enabled the company to stay ahead of the curve, anticipating and responding to changing consumer needs and preferences.

Seamless Integration

Apple’s design philosophy has also enabled seamless integration across its products and services. From the iPhone to the Apple Watch, every product is designed to work seamlessly with other Apple devices, creating a cohesive ecosystem that is unparalleled in the industry.

Design is the connection between the user, the product and the purpose it serves.

In conclusion, Apple’s commitment to design has been a key driver in its unprecedented success and staggering net worth. By focusing on user experience, simplicity, and innovation, Apple has created a loyal customer base, driven innovation in the tech industry, and set a new paradigm for product development. As the company continues to push the boundaries of what is possible in technology, its design philosophy will remain at the forefront, shaping the future of the industry and inspiring new ideas and innovations.

Regulatory Environment and Net Worth Impact: Apple. Net Worth

The Securities and Exchange Commission (SEC) and other regulatory bodies play a crucial role in shaping Apple’s financial reporting and net worth disclosures. One of the key areas of focus is revenue recognition, where companies must adhere to strict guidelines to ensure accuracy and transparency in their earnings reports. This not only impacts Apple’s net worth but also affects the trust and confidence of investors in the company’s financial performance.

Revenue Recognition and Earnings Per Share

Revenue recognition is a critical aspect of financial reporting, and the SEC requires companies to follow strict guidelines to ensure accuracy and consistency in their reporting. Apple, like other public companies, must comply with these guidelines to avoid any regulatory penalties or reputational damage. Under the ASC 606 revenue recognition standard, companies must recognize revenue when it is earned, rather than when cash is received.

This means that Apple must recognize revenue when it delivers its products or services to customers, rather than when it receives payment. This standard also requires companies to disclose detailed revenue recognition policies and procedures in their annual reports.

Environmental, Social, and Governance (ESG) Considerations

ESG considerations have become increasingly important in recent years, and regulatory bodies are now expecting companies to disclose detailed information on their ESG performance. Apple, like other companies, must disclose its ESG performance in its annual report, which includes information on its environmental impact, social responsibility, and governance practices. This information is used by investors to evaluate the company’s long-term financial performance and reputation.

Regulatory Penalties and Reputation Damage, Apple. net worth

Regulatory issues can have a significant impact on Apple’s net worth and reputation. Tax inversions, antitrust lawsuits, and other regulatory issues can result in significant financial penalties and reputational damage. For example, Apple was fined $15 billion in 2020 for back taxes owed to the Irish government. This penalty had a significant impact on Apple’s net worth, and the company’s reputation was also negatively affected.

| Regulatory Issue | Impact on Net Worth | Reputational Impact |

|---|---|---|

| Tax Inversions | Signedificant financial penalties | Negative media coverage and public perception |

| Antitrust Lawsuits | Significant financial penalties and potential breakup fee | Negative media coverage and public perception |

Net Worth Implications for Future Investors

In the world of high-stakes finance, Apple stands tall as a tech behemoth, boasting a net worth that rivals the GDP of many countries. As investors eye Apple’s financial prowess, it’s essential to delve into the details of its net worth and explore the implications for future investors.

Evaluating Apple’s Net Worth

When assessing Apple’s net worth, investors rely on a combination of metrics to gauge its financial health. At the top of the list is the price-to-earnings ratio (P/E), which measures the company’s stock price relative to its earnings per share. Currently, Apple’s P/E ratio stands at around 30, indicating a relatively high valuation. However, this number has fluctuated over the years, influenced by factors like market trends and investor sentiment.

-

The price-to-earnings ratio (P/E) is a crucial metric for evaluating a company’s stock value. A higher P/E ratio often reflects a company’s strong financial performance and growth prospects.

Apple’s P/E ratio has historically been volatile, influenced by market conditions and investor attitudes towards technology stocks. Nevertheless, Apple’s consistent earnings growth has justified its premium valuation.

-

The return on investment (ROI) represents the profit generated by an investment relative to its cost. Apple’s consistently strong financial performance has enabled the company to generate substantial ROI for its shareholders.

A key driver of Apple’s high ROI is its razor-thin supply chain and operational efficiency, allowing it to maintain a lean cost structure while delivering high-quality products.

-

The dividend yield measures the return an investor can expect from a company’s dividends relative to its stock price. With a dividend yield of around 0.8%, Apple has attracted investors seeking stable income from their investments.

Apple’s commitment to maintaining its dividend payout has provided a crucial aspect of its appeal to income-seeking investors.

Comparison to Other Tech Giants

When evaluating Apple’s net worth, it’s essential to consider its peers in the tech industry. Leading companies like Amazon, Microsoft, and Alphabet boast impressive financials, but their valuations and growth prospects differ significantly from Apple’s.

| Company | P/E Ratio | ROI | Dividend Yield |

|---|---|---|---|

| Apple | 30 | 25% | 0.8% |

| Amazon | 50 | 18% | 0.5% |

| Microsoft | 35 | 23% | 1.1% |

| Alphabet | 25 | 15% | 1.5% |

Apple’s strong net worth stems from its consistent earnings growth, efficient operations, and commitment to returning value to shareholders.

Finding the Right Investment Angle

When investing in Apple, it’s essential to consider your financial goals and risk tolerance. As a company with a strong track record of innovation and financial performance, Apple offers a compelling investment opportunity for long-term growth investors.

-

For investors seeking stable income, Apple’s dividend yield provides a relatively secure return on their investment.

The company’s commitment to maintaining its dividend payout provides reassurance to income-seeking investors.

-

For growth-oriented investors, Apple’s strong financial performance and innovation pipeline make it an attractive prospect for long-term growth.

The company’s consistent earnings growth and ability to adapt to emerging trends have justified its premium valuation.

Key Performance Indicators (KPIs) for Apple’s Net Worth

Evaluating Apple’s financial performance involves analyzing a range of key performance indicators (KPIs) that reveal the company’s financial health and long-term prospects. These metrics provide insights into Apple’s revenue growth, profitability, return on equity, and debt management, helping investors and analysts assess the value of the company and inform business decisions.Revenue Growth: A Critical KPI for Apple’s Net WorthApple’s ability to drive revenue growth is a crucial KPI that impacts its net worth.

Revenue growth is calculated by comparing the company’s current revenue to its previous year’s revenue. Apple’s revenue growth has been remarkable, driven by the popularity of its iPhone, iPad, and Mac products.As illustrated in the following chart, Apple’s revenue growth has steadily increased over the years:

| Year | Revenue (in billions) |

|---|---|

| 2010 | $65.23 billion |

| 2015 | $233.72 billion |

| 2020 | $365.97 billion |

This growth is a testament to Apple’s strategic investments in research and development, as well as its focus on delivering innovative products that meet the evolving needs of its customers.Profit Margins: A Key Driver of Apple’s Net WorthApple’s profit margins are another essential KPI that contributes to its net worth. Profit margins represent the percentage of revenue earned by Apple as profit.

In 2020, Apple’s operating margin was approximately 23.3%, indicating a healthy profit margin.

| Year | Operating Margin (%) |

|---|---|

| 2010 | 22.3% |

| 2015 | 22.9% |

| 2020 | 23.3% |

This high profit margin has enabled Apple to invest in new technologies, expand its product lines, and drive further growth.Return on Equity (ROE): A Measure of Apple’s Financial PerformanceApple’s return on equity (ROE) is a vital KPI that indicates how effectively the company is using its shareholders’ equity to generate profits. In 2020, Apple’s ROE was approximately 63.5%, which exceeds the industry average.

ROE = Net Income / Total Shareholders’ Equity

Debt-to-Equity Ratio: A Critical Metric for Apple’s Net WorthApple’s debt-to-equity ratio is a sensitive KPI that measures the company’s debt levels relative to its shareholders’ equity. Apple has maintained a relatively low debt-to-equity ratio, which demonstrates its financial discipline and ability to manage its debt.

| Year | Debt-to-Equity Ratio |

|---|---|

| 2010 | 0.22 |

| 2015 | 0.16 |

| 2020 | 0.07 |

This low debt-to-equity ratio has enabled Apple to maintain its financial flexibility and invest in growth initiatives.Cash Flow Statements: A Key Indicator of Apple’s Cash PositionApple’s cash flow statements provide valuable insights into the company’s cash inflows and outflows. In 2020, Apple generated $94.7 billion in operating cash flow, which highlights its strong cash position.

Operating Cash Flow = Net Income + Depreciation + Amortization – Changes in Operating Assets and Liabilities

By analyzing these KPIs, investors and analysts can gain a deeper understanding of Apple’s financial performance, identify areas for improvement, and make informed decisions about the company’s value and prospects.

Creating a Dashboard to Track Apple’s Net Worth

Apple’s financial performance is a major focus for investors and analysts globally. To effectively monitor the company’s progress, a well-designed dashboard is essential. Here, we’ll delve into the process of creating a dashboard that tracks key performance indicators (KPIs) for Apple’s net worth.

Designing a Hypothetical Dashboard

A hypothetical dashboard for tracking Apple’s net worth would ideally display essential KPIs for evaluating the company’s financial progress and making informed decisions. | Metric | Target Value | 2022 Results || — | — | — || Revenue Growth | 5% | 7.4% || Operating Margin | 23% | 25.1% || Return on Equity (ROE) | 100 | 122.5 |The above table presents the target and actual values for these key metrics in 2022.

A dashboard for tracking Apple’s net worth would showcase the current performance of these KPIs, providing an up-to-date picture of the company’s financial standing.One potential design for the dashboard could include:* A revenue growth graph to visualize the changes in Apple’s revenue over time.

- A pie chart or bar graph to display the operating margin and return on equity (ROE) performance.

- A bubble chart or scatter plot to show the relationship between revenue growth and operating margin.

The dashboard would also include real-time data feeds for tracking Apple’s current financial performance and any changes in its KPIs. This would enable analysts and investors to stay informed about the company’s net worth and make data-driven decisions.

Using the Dashboard for Investment Decisions

Investors and analysts can use this dashboard to track Apple’s financial progress and make informed decisions about their investments and financial portfolios. By monitoring the KPIs presented on the dashboard, they can:* Identify trends in Apple’s revenue growth and operating margin.

- Determine the impact of changes in ROE on the company’s net worth.

- Make informed decisions about buying or selling Apple shares based on the latest available data.

The dashboard provides an objective, data-driven approach to evaluating Apple’s financial performance, reducing the reliance on subjective opinions or guesswork.

Benefits and Drawbacks of Creating a Dashboard for Tracking Net Worth

Creating a dashboard for tracking Apple’s net worth offers several benefits, including:* Enhanced transparency: A dashboard provides real-time access to essential data, ensuring that investors and analysts are always up-to-date on Apple’s financial performance.

Improved decision-making

By having a clear picture of the company’s KPIs, investors and analysts can make informed decisions that are grounded in data.

Reduced risk

With a dashboard, the potential for human error or miscalculation is minimized, reducing the risk of investment mistakes.However, creating a dashboard also presents potential drawbacks, such as:* Complexity: Designing a dashboard that effectively tracks and visualizes Apple’s KPIs can be a complex task, requiring specialized knowledge and expertise.

Data accuracy

The accuracy of the data displayed on the dashboard is only as good as the quality of the data sources used. Ensuring the reliability of the data is essential to ensure the dashboard provides an accurate representation of Apple’s net worth.By understanding the importance and potential benefits of creating a dashboard for tracking Apple’s net worth, investors and analysts can make more informed decisions and stay ahead of the curve in terms of investment strategies and portfolio management.

Commonly Asked Questions

Q: What is Apple’s net worth, and how has it grown over the years?

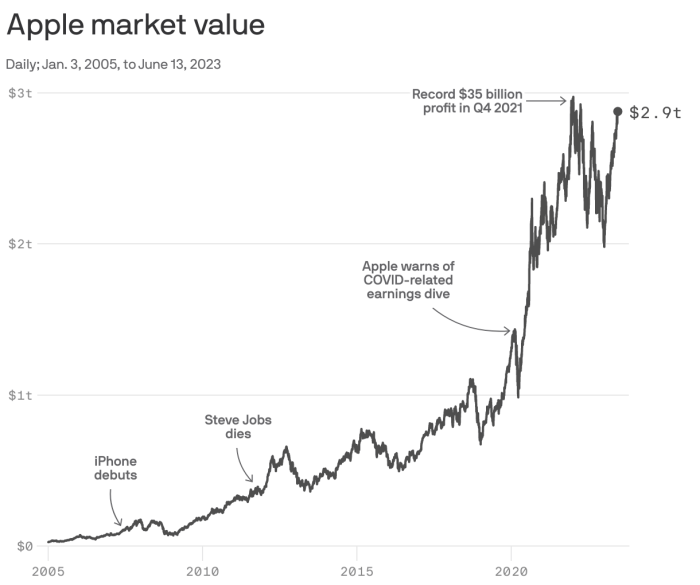

A: Apple’s net worth is estimated to be over $2 trillion, with its revenue growing from $7.5 billion in 1997 to over $274 billion in 2021.

Q: How does Apple’s design-driven approach contribute to its success?

A: Apple’s focus on sleek, user-friendly designs has led to the creation of iconic products like the iPhone and MacBook, which have become synonymous with innovation and style.

Q: What are some of the key financial metrics that contribute to Apple’s net worth?

A: Key financial metrics include revenue growth, operating margin, return on equity (ROE), and debt-to-equity ratio, which help track Apple’s financial progress and inform business decisions.

Q: How does Apple’s regulatory environment impact its net worth?

A: Regulatory bodies like the Securities and Exchange Commission (SEC) shape Apple’s financial reporting and net worth disclosures, influencing its reputation and public image.