Define upper one percent of wealth net worth – Kicking off with a closer look at the upper echelons of wealth, it becomes apparent that the term “upper one percent” often conjures up images of multi-million-dollar mansions, lavish lifestyles, and unparalleled financial wealth. But what does it really mean to be part of this exclusive club? In this article, we’ll delve into the world of high-net-worth individuals, exploring the intricacies of calculating their wealth, the significance of income inequality, and the distribution of wealth among the world’s richest 1%.

We’ll also examine the various methods used to define the upper one percent threshold in different regions, the composition of their wealth portfolios, and the tax implications that shape their investment decisions.

The concept of the upper one percent of wealth net worth is not only fascinating but also deeply complex. It involves considering various factors such as income inequality, tax policies, and economic growth, which can vary significantly across different regions and countries. For instance, in the United States, the upper one percent is often defined as individuals with a net worth above $790,000, while in China, it’s anyone with a net worth above $130,000.

This disparity highlights the need for a deeper understanding of the upper one percent’s wealth dynamics and how it impacts the global economy.

Understanding the Concept of the Upper One Percent of Wealth Net Worth

The term “upper one percent” refers to the wealthiest individuals in a given population, where one percent represents a small fraction of the total number of people. This concept has gained significant attention in recent years due to rising income inequality and its impact on the global economy.The concept of the upper one percent is often used to describe the significant wealth disparity in various countries.

The calculation of the upper one percent varies across countries, but it typically involves dividing the total wealth of a population by 100 and then ranking individuals in descending order based on their wealth.For example, in the United States, the upper one percent is calculated as follows: if the total wealth of the population is $100 trillion, the upper one percent would be the individuals with a total wealth of $1 trillion or more.

However, the global picture is more complex, as countries have different levels of economic development, population sizes, and wealth distribution.The significance of income inequality lies in its far-reaching consequences on the global economy. Research has shown that the wealthiest one percent of individuals in a country tend to hold a disproportionate amount of wealth and income, often accumulating it through investments, inheritance, and tax policies.This has led to significant disparities in access to education, healthcare, and economic opportunities.

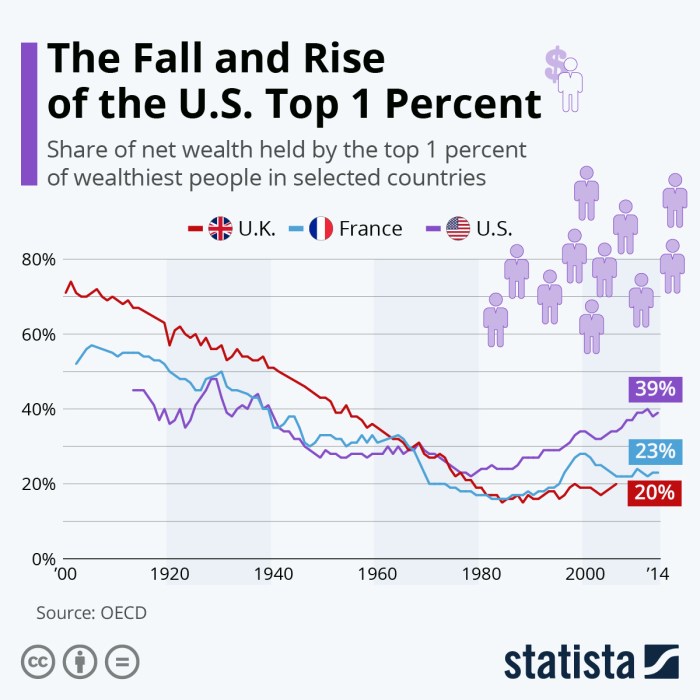

The richest one percent tends to control a significant portion of the economy, leaving the remaining population with limited opportunities to improve their economic circumstances.Data from the World Inequality Database (WID) reveals that the global wealth share of the richest one percent has increased significantly since the 1980s. In 1980, the top one percent held approximately 29% of the world’s wealth, whereas by 2016, this figure had risen to around 43%.

| Year | Wealth Share of Top 1% |

|---|---|

| 1980 | 29% |

| 1990 | 32% |

| 2000 | 36% |

| 2010 | 41% |

| 2016 | 43% |

The increasing wealth share of the richest one percent has led to concerns about the impact on the global economy and social stability. Policymakers and economists are now focusing on strategies to reduce income inequality and promote a more sustainable and equitable distribution of wealth.

Income Inequality and Its Role in Shaping the Global Economy

- The richest one percent tends to hold a disproportionate amount of wealth and income, often accumulating it through investments, inheritance, and tax policies.

- This has led to significant disparities in access to education, healthcare, and economic opportunities.

- The wealthiest one percent often controls a significant portion of the economy, leaving the remaining population with limited opportunities to improve their economic circumstances.

Income inequality has far-reaching consequences on the global economy, including reduced economic growth, decreased social mobility, and increased social unrest.

Wealth Distribution Among the Richest One Percent of Individuals Worldwide Since 1980

The global wealth share of the richest one percent has increased significantly since the 1980s. Data from the World Inequality Database (WID) reveals that the top one percent held approximately 29% of the world’s wealth in 1980.

- The global wealth share of the richest one percent has increased from 29% in 1980 to around 43% in 2016.

- The top one percent now holds a disproportionate amount of wealth and income, often accumulating it through investments, inheritance, and tax policies.

- This has led to significant disparities in access to education, healthcare, and economic opportunities.

Defining the Upper One Percent Threshold in Different Regions

In the realm of economics, the elusive “upper one percent” is a threshold that sparks curiosity and debate among scholars and policymakers. While the concept is often associated with the United States, its definition and application vary across regions. This disparity is due in part to the unique economic, cultural, and social contexts of each region. This article delves into the methods used to define the upper one percent threshold in various regions, highlighting the factors that influence these thresholds.In the United States, the upper one percent threshold is often calculated based on the total annual household income of $750,000 or above.

This figure is derived from the Economic Policy Institute’s (EPI) analysis of tax data from the Internal Revenue Service (IRS). The EPI’s definition is widely adopted in academic and policy circles, as it provides a clear and concise measure of wealth inequality.In contrast, China employs a more complex method to define the upper one percent threshold. The country’s National Bureau of Statistics (NBS) uses a combination of urban and rural income data to establish a threshold of approximately 430,000 yuan ($63,000 USD) per household.

This approach takes into account regional income disparities and the country’s unique economic development patterns.Europe, with its diverse economic landscape, employs a range of methods to define the upper one percent threshold. In the UK, for instance, the threshold is set at 150,000 pounds ($200,000 USD) per household, based on data from HM Revenue & Customs (HMRC). In Germany, the threshold is calculated using a combination of income and asset data, resulting in a threshold of around 170,000 euros ($190,000 USD) per household.A common theme among these regional definitions is the influence of tax policies on the upper one percent threshold.

Tax reforms and loopholes can significantly impact the threshold, as seen in the US, where changes to the estate tax have affected the threshold for the upper one percent.

Comparison of Wealth Thresholds in Developed and Developing Countries

The upper one percent threshold varies significantly between developed and developing countries. In developed economies like the US, the UK, and Germany, the threshold is often higher, reflecting the relative wealth and economic stability of these nations. In contrast, developing countries like China and Brazil have lower thresholds, reflecting their economic disparities and development challenges.A 2020 report by the Organisation for Economic Co-operation and Development (OECD) highlights this disparity.

According to the report, the upper one percent threshold in developed countries ranges from $230,000 to $430,000 per household, while in developing countries, the threshold is typically below $100,000.

Factors Influencing the Wealth Threshold

Several factors contribute to the variation in upper one percent thresholds across regions. Economic growth, tax policies, and social welfare programs all play a significant role.

Impact of Economic Growth

Economic growth can increase the upper one percent threshold, as rising incomes and asset values can push households above the threshold. In countries with high economic growth rates, like China, the threshold may need to be adjusted regularly to reflect the changing economic landscape.

Role of Tax Policies

Tax policies, particularly those related to income, wealth, and estate taxes, can significantly impact the upper one percent threshold. Changes in tax laws and loopholes can shift households above or below the threshold, influencing wealth inequality.

Importance of Social Welfare Programs

Social welfare programs, such as progressive taxation, social security, and public services, can help mitigate wealth inequality by redistributing wealth from the top to the bottom. In countries with robust social welfare systems, like Scandinavia, the upper one percent threshold may be lower, reflecting a more equitable distribution of wealth.

Examples of Regional Thresholds

Regional thresholds serve as a starting point for understanding wealth inequality. The following examples illustrate the variation in upper one percent thresholds across countries:

United States

$750,000 or above

China

approximately 430,000 yuan ($63,000 USD) per household

UK

150,000 pounds ($200,000 USD) per household

Germany

around 170,000 euros ($190,000 USD) per household

Brazil

approximately 200,000 reais ($45,000 USD) per household

Real-Life Implications

In conclusion, the upper one percent threshold is a complex concept that varies significantly across regions. Its definition and application are influenced by economic growth, tax policies, and social welfare programs. Regional thresholds serve as a benchmark for understanding wealth inequality and informing policy decisions. These variations underscore the need for a nuanced and context-specific approach to addressing wealth disparities across the globe.

Income Generation Strategies Among the Upper One Percent: Define Upper One Percent Of Wealth Net Worth

When it comes to the upper one percent of wealth net worth, income generation is a top priority. These high-net-worth individuals have diverse investment portfolios and a range of income-generating strategies that help them maintain their wealth. In this article, we’ll delve into the various income generation strategies employed by the upper one percent, including dividend-paying stocks, rental properties, and business ventures.The upper one percent often employ a combination of passive income streams and entrepreneurial income sources to generate wealth.

Passive income streams, such as dividend-paying stocks and rental properties, provide a steady flow of income without requiring direct involvement. On the other hand, entrepreneurial income sources, such as business ventures and investments, require active management but can provide higher returns.

Dividend-Paying Stocks

Dividend-paying stocks are a popular choice among the upper one percent. These stocks provide a regular income stream in the form of dividends, which can help offset market volatility. To get the most out of dividend-paying stocks, it’s essential to invest in high-quality companies with a history of consistently paying dividends. The key is to find companies with a high dividend yield, a reliable dividend payout history, and a strong financial position.

- Invest in index funds or ETFs that track dividend-paying stocks to gain instant diversification and reduced complexity.

- Look for companies with a long history of dividend payments to minimize the risk of a dividend cut.

- Choose companies with a strong balance sheet and a proven track record of delivering profits to ensure steady dividend payments.

Investors seeking to create a dividend-focused portfolio should prioritize companies with a stable dividend payout history and a demonstrated ability to grow their dividend payments over time.

Rental Properties

Rental properties are another income-generating strategy popular among the upper one percent. Real estate investment trusts (REITs) and direct property ownership can provide a steady stream of passive income through rental income. However, investing in rental properties requires significant capital and ongoing management. Investors must be willing to handle property maintenance, tenant screening, and other logistical issues.

- Invest in rental properties with a strong cash flow potential and minimal vacancy rates.

- Choose properties located in areas with limited supply and high demand to maximize rental income.

- Consider hiring a property management company to handle day-to-day tasks and minimize your involvement.

To succeed in rental property investing, it’s crucial to focus on acquiring high-quality properties with a strong potential for cash flow.

Business Ventures

Business ventures are a more aggressive income-generating strategy among the upper one percent. These individuals invest in startups, franchises, or other businesses with growth potential. However, entrepreneurial income streams come with higher risks and require ongoing management. Investors must be willing to take on the responsibilities of business ownership, including strategy development, financial management, and marketing.

- Invest in businesses that have a clear competitive advantage and growth potential.

- Choose industries with favorable market trends and regulatory environments.

- Assemble a strong management team to help execute the business plan and drive growth.

To succeed in business ventures, it’s essential to identify companies with a strong potential for growth and assemble a skilled management team to execute the business plan.

Education and Skill Sets

To create and sustain a successful income-generating portfolio, upper one percent individuals typically possess a broad range of skills and education. Key areas of expertise include:

- Finance: Understanding financial markets, instruments, and strategies.

- Economics: Familiarity with economic trends, policy, and industry analysis.

- Business: Knowledge of business operations, strategy, and management.

- Investing: Understanding investment vehicles, risk management, and diversification.

Effective portfolio management requires a deep understanding of these areas and the ability to leverage this knowledge in a dynamic market environment.

Passive Income Streams vs. Entrepreneurial Income Sources

When it comes to income generation, upper one percent individuals often prioritize a combination of passive income streams and entrepreneurial income sources. Passive income streams provide a steady flow of income with minimal direct involvement, while entrepreneurial income sources offer higher returns but require ongoing management. A balanced approach can help achieve long-term financial goals and maintain wealth.

Taxation of the Upper One Percent’s Wealth

The upper one percent of the wealthy population, known as the elite, have a significant amount of wealth invested in various asset classes, which are subject to different tax implications. Taxation is a crucial aspect of wealth management, as it can significantly impact an individual’s net worth and overall financial goals. In this section, we will delve into the tax implications of different asset classes, tax-advantaged investment products, and how tax laws and regulations impact the upper one percent’s investment decisions.

Description of Tax Implications of Asset Classes

The upper one percent’s wealth is often held in various asset classes, each with its own set of tax implications. Understanding these tax implications is essential for effective wealth management and minimizing tax liabilities.

- Charitable Trusts: A charitable trust is a type of trust that is used to manage and distribute wealth to charitable organizations. The tax benefits of a charitable trust include the reduction of taxable income and the ability to make tax-free distributions to charity. However, the trust must be properly set up and managed to avoid any tax implications or penalties.

- Offshore Accounts: Offshore accounts are bank accounts or other financial instruments held in a foreign country. The tax implications of offshore accounts are complex and depend on the specific country and account structure. Generally, offshore accounts can provide a reduction in tax liabilities, but they can also be subject to reporting requirements and penalties if not properly managed.

These asset classes can provide significant tax benefits, but they also come with complex tax implications and reporting requirements. Proper management and planning are essential to minimize tax liabilities and avoid any potential penalties.

Benefits and Drawbacks of Tax-Advantaged Investment Products

Tax-advantaged investment products, such as 529 plans and Roth IRAs, can provide significant tax benefits and help individuals achieve their financial goals. However, each product has its own set of benefits and drawbacks that should be carefully considered before investing.

529 Plans

A 529 plan is a type of tax-advantaged savings plan used to save for education expenses. The main benefits of a 529 plan include:* Tax-free growth of earnings

- Federal tax-free withdrawals for qualified education expenses

- State tax deductions or credits for contributions

- Potential state tax-free withdrawals for qualified expenses

However, 529 plans have some drawbacks, including:* Limited investment options

- Potential impact on financial aid eligibility

- Withdrawal penalties for non-qualified expenses

Roth IRAs

A Roth IRA is a type of tax-advantaged retirement savings plan. The main benefits of a Roth IRA include:* Tax-free growth of earnings

- Tax-free withdrawals in retirement

- Potential tax-free withdrawals for qualified first-time homebuyers

- No required minimum distributions (RMDs) in retirement

However, Roth IRAs have some drawbacks, including:* Contribution limits

- Income limits on contributions

- Potential withdrawal penalties for non-qualified expenses

In conclusion, tax-advantaged investment products can provide significant tax benefits and help individuals achieve their financial goals. However, each product has its own set of benefits and drawbacks that should be carefully considered before investing.

How Tax Laws and Regulations Impact Investment Decisions

Tax laws and regulations have a significant impact on the upper one percent’s investment decisions. Changes in tax laws and regulations can affect the tax implications of different asset classes and tax-advantaged investment products.

| Changes in Tax Laws and Regulations | Impact on Investment Decisions |

|---|---|

| Income tax rate changes | Investors may adjust their portfolios to take advantage of lower income tax rates |

| Capital gains tax changes | Investors may adjust their portfolios to minimize capital gains tax liabilities |

| Gift tax changes | Investors may adjust their estates to minimize gift tax liabilities |

Tax laws and regulations are constantly changing, and investors must stay informed to make informed investment decisions. The right investment strategy can help minimize tax liabilities and achieve financial goals.

The Impact of the Upper One Percent on Economic Growth and Development

The upper one percent of wealthy individuals have long been a subject of interest and debate among economists and policymakers. While some argue that their concentration of wealth is necessary for economic growth and job creation, others claim it leads to income inequality and social unrest. In this section, we will delve into the impact of the upper one percent on economic growth and development, exploring both sides of the argument.The role of the upper one percent in creating economic growth is undeniable.

These individuals often take risks and invest in innovative ventures, creating jobs and stimulating economic activity. For instance, entrepreneurs like Mark Zuckerberg and Elon Musk have revolutionized industries and created millions of jobs through their innovative ventures. Risk-taking is a key characteristic of successful business leaders, and their ability to take calculated risks has propelled economic growth.Innovation is another key area where the upper one percent plays a crucial role.

These individuals often invest in research and development, creating new products and services that disrupt existing markets. According to a study by the National Bureau of Economic Research, innovation is a key driver of economic growth, accounting for 80% of productivity gains in the United States between 1993 and 2016.However, the concentration of wealth among the upper one percent can also lead to economic stagnation and social unrest.

When wealth accumulates in the hands of a few individuals, the remainder of the population may struggle to achieve economic mobility, leading to feelings of frustration and disillusionment. A study by the Economic Policy Institute found that the top 1% of earners in the United States have captured 91% of the income growth since the 1970s, while the bottom 50% have seen their incomes decline.

Concentration of Wealth and Its Effects

When wealth is concentrated among a small elite, it can create a ripple effect of inequality across the economy.

- Reduced Economic Mobility: As the wealthy hold a disproportionate share of the wealth, the remainder of the population may struggle to achieve economic mobility, leading to feelings of frustration and disillusionment.

- Inadequate Consumer Spending: With reduced economic mobility, consumers may have less disposable income, leading to reduced consumer spending and economic stagnation.

- Increased Poverty: The concentration of wealth among the upper one percent can lead to increased poverty, as the remainder of the population struggles to make ends meet.

Policy Interventions to Reduce Income Inequality

Several policy interventions have been proposed to reduce income inequality and promote economic growth for all segments of society.

- Progressive Taxation: Implementing a more progressive tax system, where the wealthy are taxed at a higher rate, can help reduce income inequality. A study by the Tax Policy Center found that a tax rate of 55% on income above $10 million could reduce the top 1% of earners’ tax burden by 25%.

- Increased Minimum Wage: Raising the minimum wage can help ensure that workers earn a living wage, reducing poverty and increasing economic mobility. A study by the Economic Policy Institute found that a $15 minimum wage could lift 40 million workers out of poverty.

- Education and Job Training: Investing in education and job training programs can help workers develop the skills needed to compete in the modern economy, increasing their earning potential and reducing income inequality.

- Economic Incentives: Implementing economic incentives, such as tax credits or subsidies, can encourage businesses to invest in low-income communities, creating jobs and stimulating economic growth.

Solution is in the Numbers: Real-Life Examples

In 2018, the city of Stockton, California, launched a universal basic income experiment, providing 125 low-income residents with $500 per month for 18 months. The results were staggering, with 78% of participants seeing improvements in their mental and physical health, and 67% reporting reduced stress levels.

Key Takeaways, Define upper one percent of wealth net worth

Certain strategies, such as progressive taxation and increased minimum wage, can help to redistribute wealth and promote economic growth for all segments of society.

“The concentration of wealth among a small elite is a ticking time bomb for social unrest and economic stagnation.”

Nobel laureate Joseph Stiglitz

Question & Answer Hub

Q1: What is the threshold for being part of the upper one percent in the United States?

The threshold for being part of the upper one percent in the United States is a net worth above $790,000.

Q2: How does income inequality impact the upper one percent’s wealth dynamics?

Income inequality plays a significant role in shaping the upper one percent’s wealth dynamics, as those with higher incomes tend to accumulate more wealth and have greater access to investment opportunities.

Q3: What are some common tax implications for the upper one percent’s investment decisions?

The upper one percent’s investment decisions are often influenced by tax considerations, such as tax-advantaged products like 529 plans and Roth IRAs, which can help minimize their tax liability.

Q4: How does the upper one percent’s wealth impact the global economy?

The upper one percent’s wealth can have both positive and negative impacts on the global economy, depending on their investment strategies and the economic policies in place.